Selorm Adadevoh

MTN Ghana has recorded a GHS2 billion profit after tax in 2021 representing a 43 per cent increase from the previous year’s figure.

The company has therefore proposed to pay shareholders GHS0.085 dividend per share in addition to the GHS0.030 paid mid-year, making a total of GHS0.115 dividend per share for the year.

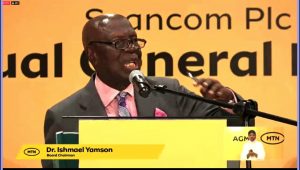

Board Chairman of MTN Ghana, Dr. Ishmael Yamson who announced this at the 4th Annual General Meeting of the telco company in Accra said the declared dividend means MTN Ghana is paying 70.3 per cent of its profit after tax to shareholders.

Dr. Yamson noted that MTN Ghana continuous to be the highest taxpayer in Ghana paying some GHS3.1 billion taxes, out of which some GHS2.3 billion was direct and indirect taxes.

He said the taxes paid by MTN in 2021 constituted 43 per cent of its total revenue for the year, which it belief it has impacted over 500,000 Ghanaians in terms of direct and indirect jobs.

Dr. Yamson said in the year under review, the MTN Ghana Foundation also spent a total of GHS14.3 million on various educational, health and economic empowerment projects particularly in the area of digital skills enhancement.

He further noted that MTN Ghana has earmarked GHS20 million for corporate social investment this year with some projects already started.

Chief Executive Officer of MTN Ghana, Selorm Adadevoh, giving an overview of the company’s operations said GHS1.5 billion was used as Capital Expenditure (CAPEX) to improve the network and quality of service and experience for customers.

He explained that during the period – 4G network coverage was improved to over 90 per cent with an addition 1,446 sites to reach an extra 1.7 million people with 4G.

Mr. Adadevoh further noted that the company added on 131 2G sites, 130 3G sites, while some 1,200 sites were modernised to improve customer experience.

He said during the year, service revenue grew 28.5 per cent year-on-year, driven mainly by a 58 per cent growth in data revenue (adding 36% to service revenue), 38 per cent growth in mobile money revenue supported by some 4.9 per cent growth in voice revenue.

Meanwhile, the company saw one million additional subscribers and a significant rise in the number of smartphones on its network in 2021.

The meeting, among other things saw the approval the Audited Financial Statements for the year ended December 31, 2021; declaration of a final dividend for the year ended December 31, 2021, the appointment of an Executive Director, authorisation of the Directors to fix the remuneration of the Auditor for the year 2022, and approval of Director’s fees for the financial year 2022.

MTN Ghana held its first AGM in May 2019 after it was listed on the Ghana Stock Exchange (GSE) on 5 September 2018 with the largest number of Ghanaian shareholdings of any listed company on the GSE at 127,826.

By raising ¢1,146,589,464.75 from 128,152 applicants, the offer made history as the largest primary share offer in the history of the Ghana Stock Exchange.

By Jamila Akweley Okertchiri