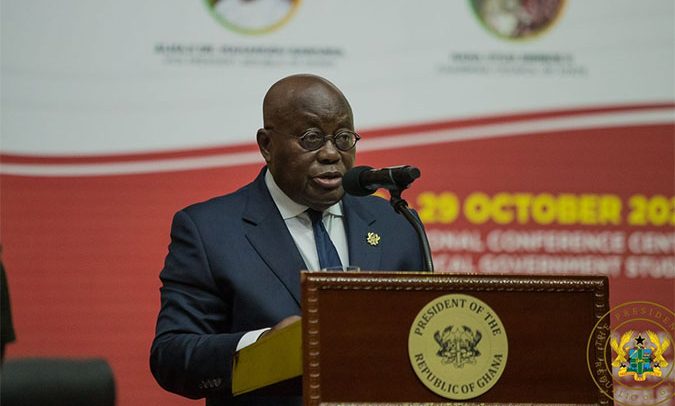

President Nana Akufo-Addo

PRESIDENT AKUFO-Addo says “the time has come for Africa to move towards an economic model which will serve its interests.”

He said this has become urgent because “profits from our resources have benefitted foreign creditors for too long, while we suffer abusive borrowing costs on the international capital markets.”

He made the observation when he opened the 57th African Development Bank (AfDB) and 48th African Development Fund (ADF) Annual General Meetings in Accra yesterday.

He believes “there is no basis for our economies being saddled with a so-called “African Risk Premium”, which translates into higher spreads than for our European and American counterparts, particularly when our resources were the catalysts for the economic advancement of Western nations.”

He, therefore, noted that “it is time we worked to address the structural barriers to our development.”

Apart from that, he stressed the need to deal with what he called “tax-dodging” and illegitimate commercial transactions by multinationals, which account for 60% of the US$88 billion of illicit financial flows from the continent annually, and other relationships which inhibit Africa’s development.

Conviction

President Akufo-Addo told his colleague leaders, some of whom were present, “We must support the bank to do what a bank does – to mobilise and invest funds.”

Aside that, he indicated that “we must activate a process that moves this bank from the corridors of ‘billions to trillions’, given the scale of the challenges on this continent.”

“Ultimately, the AfDB must become the dominant financing institution for African transformation in the medium term. This means we must bridge and overhaul the financing gap that exists with other complementary institutions,” he emphasised.

For instance, he noted that “the financing gap between the IDA, the concessionary arm of the World Bank in Africa, and ADF now stands at almost five-fold, that is $15 billion compared to the ADF’s $3 billion per year.”

Clarion Call

“It is now time to ease the regulations that shackles the bank from optimising its resources. Amending the articles that precludes the ADF from entering the market to leverage its resource must be first-order priority. In July last year, the IDA of World Bank (the equivalent of ADF) priced a 10-year Sustainable Development Bond that raised two billion euros (€2 billion). Subsequently, IDA’s funding programme expanded from US$5 billion in 2020 to US$10 billion in 2021. Such is the demonstrated power of the market beckoning the ADF. With an ADF equity of US$26 billion, the prospects could be an additional US$8-10 billion which could drive sustained transformation, especially for both fragile and states in transition on this continent,” he added.

He also talked of the need to sustain efforts to leverage private investments into Africa since the Organisation for Economic Co-operation and Development (OECD) suggests that the US$2.5 trillion financing gap for the SDG could balloon to $4.2 trillion.

According to him, this points out that this gap could be filled by re-aligning just 1.1% of the $379 trillion in global financial assets under management, whilst insisting “AfDB must lead in crowding in these resources and demonstrate foremost interest in the proposal by the AU to explore the issuance of Security-Indexed Investment Bonds to raise funds to address the root causes of increasing insecurity and poverty.”

Belief

With increased financial resources, President Akufo-Addo was more than certain that “the bank could recapitalise key African financial institutions, such as the Regional Development Banks, Afreximbank, Africa Guarantee Fund, Africa-Reinsurance Company and Africa50.”

That, he said “will harness the collective institutional strengths of Africa for sustained transformation, and avoid the situation whereby, for example, the IMF, as at the end of 2021, was able to lend forty-one billion dollars ($41 billion) to Argentina, with a population of 45 million people, compared to thirty-four billion dollars ($34 billion) for the whole of sub-Saharan Africa, with a population of 1.14 billion people.”

Challenge

He opined that “the cost of climate to our common humanity keeps increasing, with our continent bearing a disproportionate burden, though we have caused the least emissions of 3.8%, with the Western nations being responsible for 76 %.”

In spite of that, he said “only $6 billion out of the worldwide total of $30 billion of climate adaptation finance flows to Africa, even though the United Nations Environment Programme has projected that between 75 million and 250 million people would be affected by climate-induced water stress. Not to mention, financing COP26 compliance could potentially strand Africa’s natural resources, including natural gas.”

BY Charles Takyi-Boadu