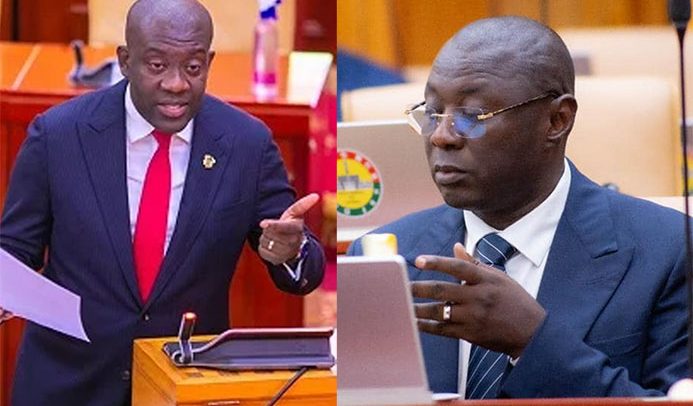

Kojo Oppong Nkrumah and Dr. Mohammed Amin Adam

A controversial attempt to extend the Special Import Levy indefinitely by the government has been blocked by two New Patriotic Party (NPP) Members of Parliament, Kojo Oppong Nkrumah and Dr. Mohammed Amin Adam.

The Special Import Levy, which was originally set to expire on December 31, 2025, faced an attempted amendment by Finance Committee Chairman, Isaac Adongo, who is also the National Democratic Congress (NDC) MP for Bolgatanga Central, to remove its expiration date, effectively making it a permanent tax.

However, the two opposition MPs pushed back against the move, arguing that it would place an unnecessary financial burden on businesses and contradict the government’s prior promises to abolish excessive taxes.

Speaking on the floor of Parliament, Mr. Oppong Nkrumah, who is the NPP MP for Ofoase-Ayirebi, argued that such a move would be improper and legally unfounded.

He emphasised that a revenue bill cannot be introduced by a private member but must come from the government.

“A revenue bill cannot be by private members’ movement or motion. The government is the only authority allowed to introduce such a bill,” he stated.

The government had initially proposed an extension of the Special Import Levy until 2028.

However, Mr. Oppong Nkrumah raised concerns over an attempt by the Chairman of the Finance Committee to push for an indefinite extension, an amendment he argued was not backed by Cabinet approval. “Even the Minister, without Cabinet approval, would not be well-grounded to amend the government’s position,” he asserted.

Dr. Mohammed Amin Adam, NPP MP for Karaga, echoed these sentiments, criticising the government for breaking its own campaign promises.

“You are breaking the tradition you have set for yourself, and this is not what the Ghanaian people voted for. You actually promised you were going to abolish it. And now, you are extending it and even extending it in perpetuity. This is not acceptable,” he stated.

Mr. Oppong Nkrumah again pointed out that its continued imposition would contribute to the high cost of imports, particularly affecting spare parts and machinery.

He recalled that former President John Dramani Mahama had previously criticized the excessive taxes at Ghanaian ports and promised to remove some of them.

“Now, the government is electing to extend this tax into 2026, 2027, and 2028—and there was even an attempt to extend it into perpetuity. This will increase the cost of imports and drive up the cost of transport due to higher prices of spare parts,” he cautioned.

Dr. Amin Adam further criticised the impact of the levy on businesses, particularly manufacturing companies, stating that they needed relief rather than additional financial burdens. “Manufacturing companies are suffering.

They need relief. The best this government can do is to provide incentives to them, not to reintroduce the tax that they have been complaining about day and night,” he argued.

He also questioned the inconsistency in the government’s position, noting that the Finance Minister had initially presented a different stance at the committee level.

“I was wondering whose position he was presenting here in this chamber. Since when has that departed from the government position the Minister presented to the committee?” he asked.

Dr. Amin Adam proposed an alternative, suggesting that if the government were to be fair to businesses, the sunset clause should be extended only until 2026, not 2028 or indefinitely.

“We have seen, over the last two years, the manufacturing sector contribution to growth increasing. The least we can do is not to reintroduce new taxes and extend them into perpetuity. We should give them relief so that we can accelerate growth for the benefit of the people of Ghana,” he urged.

He stated that extending the levy indefinitely would be unfair to Ghanaians and the private sector, emphasising that the opposition vehemently disagreed with such a move.

Adongo

In response, Isaac Adongo, the Chairman of the Finance Committee, dismissed the opposition’s stance, labeling it as inconsistent and hypocritical.

He pointed out that the same politicians opposing the levy’s extension were responsible for imposing it year after year during their tenure.

“By descendants of those who imposed this tax in 2017, imposed it in 2018, imposed it in 2019, imposed it in 2020, imposed it in 2021, imposed it in 2022, imposed it in 2023, imposed it in 2025, are today behaving as if they have never seen this tax,” he argued.

Adongo further accused the opposition of harming the private sector over the years, only to now claim they are concerned about its well-being.

“When you were imposing it, there was no private business organization. There was no cost of doing business. He who comes to equity must come with clean hands, not when your hand is soiled with blood,” he stated.

He argued that the extension was necessary to ensure certainty in tax collection and government revenue planning.

“By 2028, you will be passing an expenditure in advance of appropriation. And in that advance, expenditure in advance of appropriation, you will technically be proposing to impose this tax, even in the three months,” he explained.

Adongo questioned whether removing the tax now would undo the years of burdens placed on businesses under the opposition’s tenure.

By Ernest Kofi Adu, Parliament House