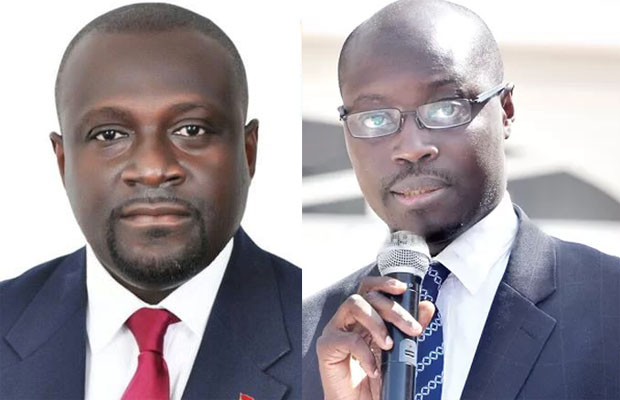

Dr Mark Assibey-Yeboah and Cassiel Ato Forson

The Chairman of the Finance Committee of Parliament, Dr Mark Assibey-Yeboah and the ranking member of the same committee, Cassiel Ato Forson, yesterday clashed on the quantum of debt added to total debt of GH?122.3 billion left by the previous National Democratic Congress (NDC) administration in 2016.

The Finance Committee’s report on the 2017 Annual Public Debt Report laid in Parliament on March 23, 2018 by the Finance Minister had put Ghana’s public debt stock as at December 31, 2017 at GH?142.6 billion, an increase of GH?20.8 billion.

But the ranking member and some minority members on the Finance Committee contested the figure strongly, saying that the figure did not include the Energy Sector Bond and UT-Capital Bank Bond.

According to the ranking member, who is also the National Democratic Congress (NDC) Member of Parliament for Ajumako/Enyan/Essiam, the Energy Sector, which was GH?4.7 billion and GH?2.3 billion support, extended to the Ghana Commercial Bank (GCB) as a result of collapse of the two banks were not recorded as part of the public debt.

He said the Energy Sector Bond and UT-Capital Bank Bond had been captured in the annual reports of the International Monetary Fund (IMF) and the World Bank as part of the public debts of Ghana, thus making the total debt of the country as of December 31, 2017 a whopping GH?150 billion.

“The rate at which the current government is borrowing is very worrying especially when the monies being borrowed are not being invested in capital infrastructure that can pay for themselves but are being spent on goods and services,” the ranking member said.

Another member of the Finance Committee, and NDC Member of Parliament (MP) for Bolgatanga Central, Isaac Adongo, said the Finance Minister was not truthful to Parliament when he told the House that the NPP government did not borrow externally in 2017.

The report he presented is saying that the government increased the external debt of the country from GH?68.9 billion to GH?75.8 billion.

According to him, the Finance Minister ought to come to Parliament to explain the increment in the external debt of the country.

The Majority Leader, Osei Kyei-Mensah-Bonsu, on his part, said that rapid rise in the country’s debt stock was a result of the ‘reckless’ borrowing by the NDC administration which resulted in huge interest payment on those hugely accumulated loans.

He said for instance that in 2016, the country had to budget for a whopping amount of GH?10 billion for the payment of loans which eventually increased the total debt stock of the country.

He, therefore, proposed that a new committee on the economy be set up in Parliament to solely scrutinise loans that are brought before Parliament by the Executive.

The Finance Committee’s report presented by Dr Assibey-Yeboah said the total public debt as a percentage of Gross Domestic Product (GDP), which had increased consistently to about 73.1 percent as at the end of 2016 declined to 69.8 percent by the end of 2017.

“Government’s borrowing plan for 2017 was guided by the revised fiscal deficit target 6.3 percent of GDP (GH?12.8 billion),” he said, adding that as a result of declining monetary policy rate and improved macroeconomic conditions, interest rates on Treasury Securities declined significantly in 2017 with the 91-day Treasury Bill ending in 2017 at 13.3 percent.

By Thomas Fosu Jnr