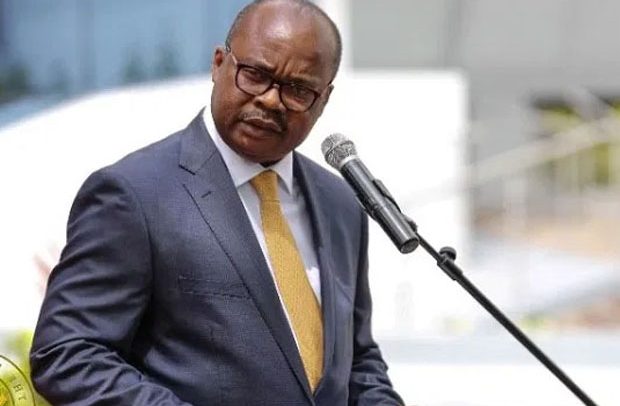

Dr Ernest Addison

The Monetary Policy Committee (MPC) of the Bank of Ghana (BoG) has increased the policy rate to 29.5 percent.

According to the Central bank, this is to place the economy firmly on the path of stability to re-anchor inflation expectation towards the medium-term target.

Addressing a press conference in Accra on Monday, March 27, at the 111th Monetary Policy Committee (MPC) meeting in Accra on Monday, March 27, Governor of the BOG, Dr Ernest Addison said “To place the economy firmly on the path of stability, it is important that the monetary policy stance be tuned further to re-anchor inflation expectation towards the medium-term target.

“Given these considerations, the MPC decided to increase the Monetary Policy Rate by a 150 basis points to 29.5 percent.”

Meanwhile, Dr. Addison has denied allegations that the central bank printed more cash to finance the government’s budget in year 2022.

According to him, there is no need for the central bank to print extra cash when it has enough cash sitting in its vault.

He described the allegations that Bank of Ghana prints money to finance overdraft as completely wrong, mischievous way of presenting the issues.

Dr. Addison pointed out that whenever it becomes necessary, the BoG releases the cash to support the economic demands.

He mentioned “First and foremost, Bank of Ghana’s forecast for currency printing does not include government financing needs, we make an estimate of the GDP for the year, a major factor in that is the cocoa production forecast. So that is what goes into forecasting currency printing requirements.

“If you go to the Bank’s office at Spintex Road we have our currency processing center there, we have a vault full of Cedis so we don’t need to print money, we already have cash sitting in our vault and release these resources as an when the economy demands that.

“So the impression that Bank of Ghana prints money to finance overdraft is completely wrong, it is a mischievous way of presenting the issues.”

By Vincent Kubi