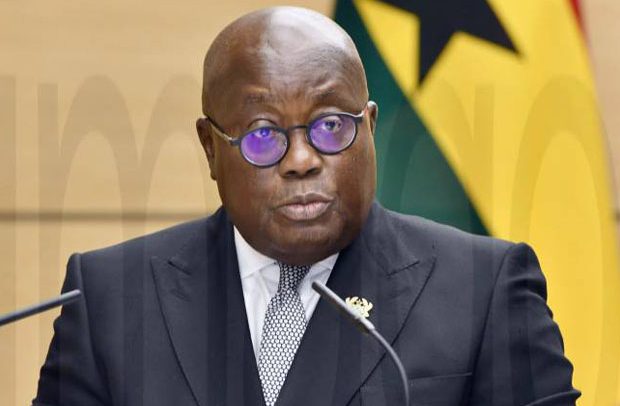

President Nana Addo Dankwa Akufo-Addo has said that consistent downgrades of Ghana’s economy by credit rating agencies have contributed to the country’s current economic woes.

Akufo-Addo said that such “reckless downgrades” are not in the best interests of developing countries like Ghana.

Speaking at the 30th-anniversary celebration of the African Export-Import Bank in Accra, Akufo-Addo said that such ratings put undue pressure on African economies.

Stressing the impacts of the ratings, president Akufo-Addo said being “the AU champion for African financial institutions and leader of a country that recently had to deal with one of the most difficult periods in his post-independent history, difficulties that were exacerbated by the reckless behaviour of rating agencies that engaged in pro-cyclical downgrades that shut Ghana out of the capital market and turned a liquidity crisis into a solvency crisis.”

Akufo-Addo also highlighted the risks and costs associated with African nations relying on foreign capital markets.

In his keynote address, the president said that it is important for Africans to build their own indigenous financial institutions in order to achieve economic growth through domestic resource mobilization and private sector development.

He explained the drawbacks of depending on foreign capital, citing financial leakages, high borrowing rates, and interest payments as key issues.

According to him, such reliance undermines the growth of domestic financial institutions and hampers the development of African economies.

He ended his speech by proposing some interventions that African leaders should embrace to overcome the current economic challenges.

He emphasized the importance of capitalization and effective coordination with the African Union.

“Unless we have strong financial institutions, we are not going to develop. We have learnt over the decades that relying on foreign capital is both risky and costly. It has resulted in huge financial leakages to a high cost of default-driven borrowing rates and interest payments and undermines the growth of our financial institution’s domestic resource mobilization and private sector development.”