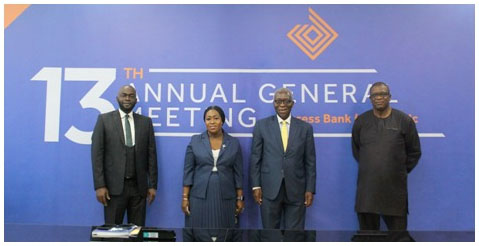

Olumide Olatunji (MD), Helen DeCardi Nelson (Company Secretary), Frank Beecham (Board Chairman) and Dolapo Ogundimu (MD-African Subsidiaries) during the meeting

SHAREHOLDERS OF Access Bank (Ghana) Plc have commended the bank for its positive growth trajectory over the last three years, signalling a strong commitment towards achieving its strategic business objective of ranking amongst the top tier banks in Ghana.

Though a difficult year globally with many sectors being impacted by the effects of the Covid-19 pandemic, the bank delivered an impressive performance on key focus areas that builds on the 2019 financial performance.

Board Chairman of Access Bank Ghana, Frank Beecham, explained that the bank’s performance over the last three years demonstrates its strong fundamentals, robust strategy and efficient use of resources to deliver success at every level.

At its 13th annual general meeting (AGM) to consider and adopt the Statement of Accounts for the year ended December 31, 2020 at its head office meeting, Mr. Beecham indicated that in the past financial year, Access Bank delivered a 62% growth in profit-before-tax (PBT) from GH¢220 million in 2019 to GH¢355 million, reflecting the strides made in cost efficiencies, asset creation and deposit mix.

Total Customer Deposits witnessed a 30% growth from GH¢3 billion in 2019 to GH¢3.9 billion in 2020, with total assets at 24% growth from GH¢4.7 billion in 2019 to GH¢5.8 billion in 2020.

He added that the board was unable to recommend the payment of dividends to shareholders based on the uncertainties that continue to be posed by the COVID-19 pandemic, and going by the directives of the Bank of Ghana.

He was however confident that the decision of the board will enable the bank deal adequately with issues emerging from the pandemic.

“We have entered 2021, with a more robust balance sheet, deeper customer insights and a more agile business that can respond to disruptions, protect and serve stakeholder interests. Leveraging on these opportunities, we shall continue to focus on consolidating our strengths in retail and digital banking, with increased investments, whilst paying more attention to upscaling our people with relevant skills set to work more efficiently,” he concluded.

Further updating shareholders at the AGM, the Managing Director of Access Bank Ghana, Olumide Olatunji said, “In spite of some of the very difficult decisions we had to take, our responsibility to our customers and our communities did not change. To demonstrate our strong resolve in giving back to the society and in the spirit of the well-being of humanity, Access Bank did not hesitate to get involved in lending its support to stem the spread in Ghana.”

He added that the past year afforded the bank an opportunity to accelerate adoption, on-boarding and utilisation of its digital banking products by both retail and corporate customers, which led to a surge in the number of transactions across the bank that terminate online without physical interaction.

Shareholders approved all resolutions on the agenda which included the re-election of the Board Directors of the company and authorising directors to fix the fees of the auditors at the virtual meeting. The shareholders adopted the 2020 audited financials as presented by Ernst & Young Chartered Accountants for the period.

A Business Desk Report