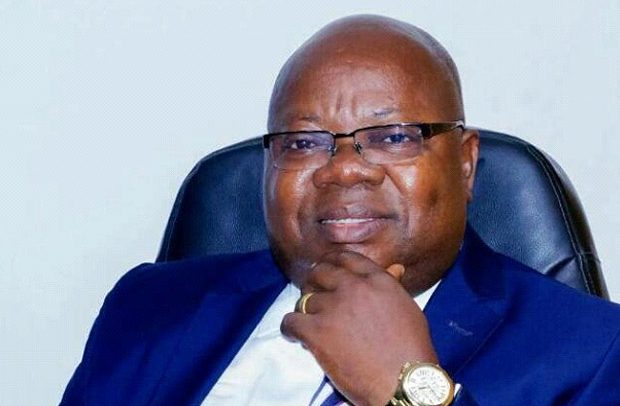

Dr. John K. Mensah

ADB BANK has registered significant strides in customer deposits in the past three years.

From GH¢2.1 billion in December 2016 to GH¢3.0 billion as of September 2019, this represents 42.8% growth.

According to the Managing Director, Dr. John K. Mensah, such growth had been the result of a combination of deposit mobilization strategies targeted at the para-statal, corporate, SME and retail markets. Besides, the bank’s shareholders equity progressively increased over the period.

Dr. Mensah, who disclosed these at a press soiree recently in Accra, said beyond the initial public offer in 2016, which brought in an additional equity of GH¢200 million, the bank, through a rights issue, raised GH¢277 million. He also said with the fresh injection from GAT, the bank was poised to expand its activities even further.

“From back-to-back operating losses recorded in 2015 and 2016, the bank has since 2017 set itself on a trajectory of profitability, recording GH¢47.3 million in 2017 and GH¢34.1 million in 2018. The bank is well on course to achieve profitability in 2019 as well,” he noted.

He continued that with units set up under its agribusiness portfolio for specific government initiatives such as 1D1F and GREL project, ADB Bank had also targeted to grow its agriculture loan portfolio by 50% of total loans by 2022.

Additionally, ADB Bank has introduced new digital products to its already existing e-Business products. Dr. Mensah continued that the bank was aiming to grow bigger by pursing its five-year strategic plan.

This involves financial growth by which it will drive a strong and robust balance sheet with good quality loans with emphasis on agribusiness and agric value chain activities; increasing its market share through customer care and service quality as well as innovative products and services; and working on its human capital development to continue to enhance job satisfaction, increase motivation and professionalism in our staff.

On market development, he said ADB Bank was venturing into untapped markets through selective market entries, and setting up non-banking financial institutions and CSR.

ADB Bank was first established as the Rural Credit Department of the Bank of Ghana in 1964 to study the problems of agricultural credit, and prepare the necessary legislation, plans and procedures for the establishment of an Agricultural Credit Bank.