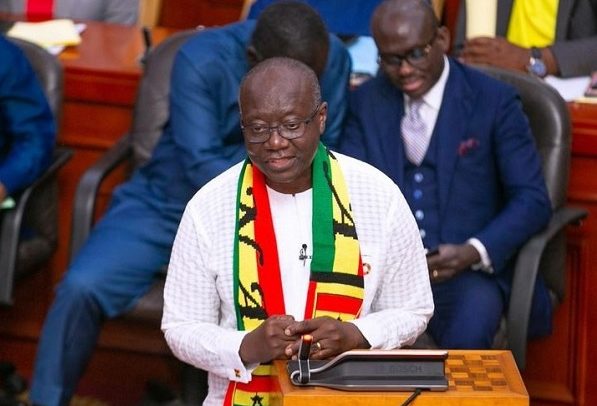

Ken Ofori-Atta

MINISTER OF Finance, Ken Ofori-Atta, announced a reduction of the headline rate of the Electronic Transfer Levy (E-Levy) from 1.5% to 1%, as part of revenue measures contained in the 2023 budget statement presented to Parliament yesterday.

The flagship tax legislation on electronic transactions was initially pegged at 1.75% in the 2022 Budget Statement and Economic Policy of the Government presented to the House in November last year, and was passed at 1.5% amidst protest from the NDC Minority MPs.

According to the Finance Minister, the reduction of the rate of the transaction value has been done alongside the removal of the daily threshold of GH¢100.

He said the government had received several proposals for review of the E-Levy and was working closely with all stakeholders to evaluate the impact of the levy in order to decide on the next line of action, which would include revision of the various exclusions.

“To this end, the income tax regime will undergo reforms to among others, review the upper limits for vehicle benefits and introduce an additional income tax bracket of 35%,” Mr. Ofori-Atta stated.

He asserted the government had consistently indicated its intention to improve the revenue collection effort by leveraging technology to enhance tax administration, identify and register taxable persons and improve tax compliance, noting the reduction of the E-Levy rate was the first step.

Resource Mobilisation

The minister disclosed that total revenue and grants are projected at GH¢143,956 million (18.0% of GDP) and are underpinned by permanent revenue measures – largely tax revenue measures – amounting to 1.35% of GDP as outlined in the revenue measures.

“Total expenditure (including clearance of arrears) is projected at GH¢205,431 million (25.6% of GDP). This estimate shows a contraction of 0.3 percentage points of GDP in primary expenditures (commitment basis) compared to the projected outturn in 2022 and a demonstration of Government’s resolve to consolidate its public finances,” he said.

He stated that projected GH¢44,990 million (5.6% of GDP) compensation for employees, projected GH¢8,048 million (1.0% of GDP) for use of goods and services, projected GH¢52,550 million (6.6% of GDP) for interest payment, estimated GH¢30,079 million (3.8% of GDP) for grants to other government units, and projected GH¢27,694 million (3.5% of GDP) for CAPEX, underpin the resource allocation for 2023 financial year.

“Mr. Speaker, other expenditure, mainly comprising Energy Sector Levies (ESL) transfers and Energy Sector Payment Shortfalls is estimated at GH¢26,739 million,” he revealed.

Financing Operations

Mr. Ofori-Atta said based on the estimates for total revenue & grants and total expenditure (including arrears clearance), the overall budget balance to be financed is a fiscal deficit of GH¢61,475 million, equivalent to 7.7 per cent of GDP.

The corresponding primary balance, he noted, is a deficit of GH¢8,925 million, equivalent to 1.1 per cent of GDP.

“I wish to notify you that, budget items such as interest payments, amortisation and financing will be adjusted accordingly once Government’s debt management strategy and financing to be provided by international partners in the context of the Fund-supported programme have been finalised,” he indicated.

Developing Local Capacity

He reiterated that Ghana’s heavy dependence on imports places tremendous pressure on the Cedi, creating an unfavourable balance of payments position, pointing out that on average, Ghana’s import bill exceeds US$10 billion annually.

According to him, this is accounted for by a diverse range of items that include iron, steel, aluminum, sugar, rice, fish, poultry, palm oil, cement, fertilisers, pharmaceuticals, toilet roll, toothpick, fruit juices, among others.

“We currently have the capacity as a country to locally produce items that account for about 45 per cent of the value of our annual imports. These include rice, fish, sugar, poultry, cement, pharmaceuticals, jute bags, computers, etc.,” he disclosed.

The Finance Minister said the government would target these products for import substitution by supporting the private sector, through partnerships with existing and prospective businesses to expand, rehabilitate and establish manufacturing plants targeted at producing these selected items.

By Ernest Kofi Adu, Parliament House