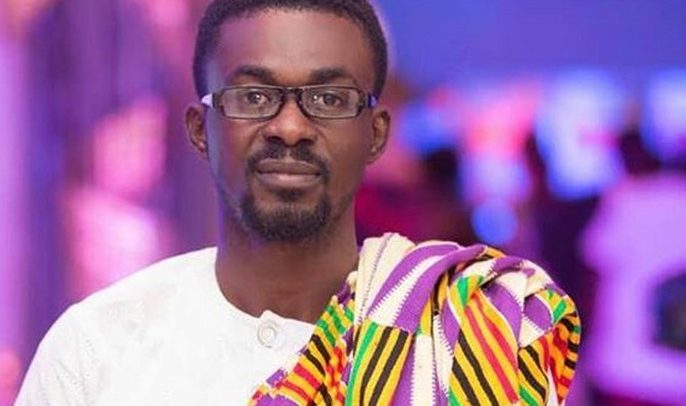

Nana Appiah Mensah aka NAM1

The embattled Chief Executive Officer of troubled gold dealership firm, Menzgold Ghana Limited, Nana Appiah Mensah (NAM1), would be making his first appearance before an Accra High Court today following new charges filed against him.

NAM1 and his companies – Menzgold and Brew Marketing Consult Limited have been charged with 39 counts of defrauding by false pretence, inducing members of the public to invest a total of GH¢1,680,920,000 in the company by claiming that the company was registered to take gold deposits in return for profits, a statement which was misleading.

NAM1, who is expected to represent his companies, would be appearing before the Economic and Financial Crime Court 1, where his plea would be taken and other issues regarding pre trial sorted out.

The three have been charged with a total of thirty-nine counts – one count of selling gold without licence, one count of operating deposit-taking business, one count of inducement to invest, 22 counts of defrauding by false pretence, seven counts of fraudulent breach of trust, and seven counts of money laundering.

The allegations levelled against them relates to them defrauding their customers various sums of monies ranging between GH¢20 million and GH¢243 million between 2016 and 2018.

NAM1, his company and wife were standing trial at the Circuit Court in Accra on a charge sheet filed in 2019, but the case had to be adjourned countless times due to the case docket being sent to the Office of the Attorney General for study and advice.

Court documents indicate that NAM1, Menzgold and Brew Consult between 2016 and 2018 dishonestly appropriated a total of GH¢105,890,811 of depositors’ money to Zylofon Media, a company related to NAM1.

The documents also state that NAM1 and Menzgold between October 2017 and July 2018 dishonestly appropriated a total of GH¢132,142,141.3 million which was entrusted to them on behalf of Menzgold for the benefit of its depositors by causing the money to be transferred to NAM1.

The charge sheet also adds that GH¢66 million of depositors’ funds invested in Menzgold was transferred to Abigail Mensah between July 2018 and August 2018 for the benefit of NAM1 and his companies.

The documents filed at the registry of the court by the Attorney General, Godfred Yeboah Dame, indicates that NAM1 operated Menzgold as a deposit-taking business under the guise of trading gold, without the requisite licence.

They said the Bank of Ghana (BoG) on March 11, 2015, issued a public notice to the effect that Menzbank was an unlicensed deposit-taking institution, but NAM1 in a bid to circumvent the BoG notice, changed the company’s name from Menzbank to Menzbanc and then later to Menzgold in 2017.

They point out that between 2017 and 2018, NAM1 and Menzgold invited members of the public to purchase gold and gold collectibles from Brew Consult and deposit same with Menzgold, promising a profit margin between 7% and 10%.

“In response to this invitation, over 16,000 members of the public deposited huge sums of money with the expectation that they were dealing with an authorised deposit-taking business which would guarantee them the returns as advertised by the accused persons,” it added.

The documents indicate that NAM1 and Menzgold continued with their operations despite several engagements and warning notices issued by the relevant agencies, while investors started facing challenges either with delayed payments or reduced dividends; a number of cheques issued by the two were also dishonoured.

Between November 2016 and March 2019, customers of the company petitioned the police and complained that they had invested huge sums of money with them but were unable to realise their investments.

The documents add that investigations revealed that the three accused under false pretence took a total of GH¢1,680,920,000 from their customers, which the customers have not recovered.

The investigations also reveal that huge sums of depositors’ funds were transferred from Menzgold and Brew to the personal account of NAM1 for his use.

By Gibril Abdul Razak