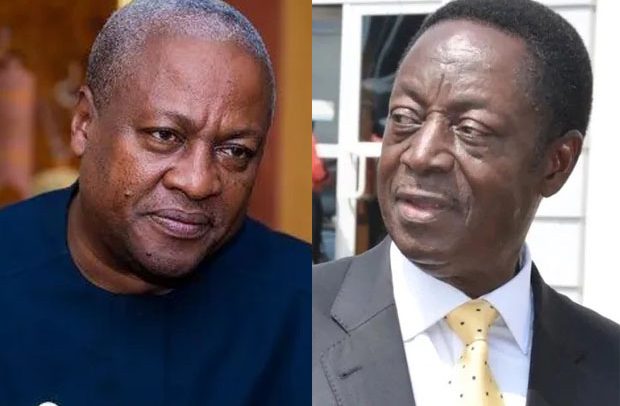

John Mahama and Dr. Kwabena Duffuor

It has emerged that the processes for the establishment of a minerals royalties company for Ghana were started by the National Democratic Congress (NDC) when it was in power in 2010.

The Professor Mills-led NDC administration began the process to create a gold royalty company for Ghana similar to the Agyapa Minerals Royalty Company Limited being established by the New Patriotic Party (NPP) administration.

The NDC tried to establish a company called the Ghana Gold Company (GGC), as a special purpose vehicle (SPV) like Agyapa Royalties, to hold the country’s gold royalties and equity interest.

Documents available are showing that the purpose for the NDC SPV was to “manage and maximize the financial returns from the country’s interest and royalties from gold companies and mines” and they even said the company would behave like Franco Neveda, a private gold-focused royalty company, with additional interest in platinum metal, oil and gas.

Budget Statement

The Ghana Gold Company formation was even mentioned in the NDC government budget statement presented on November 2010 ahead of the 2011 financial year.

The budget statement presented to Parliament by the then Finance Minister, Dr. Kwabena Duffuor, had mentioned that “currently, Ghana has shares and carried interests in a number of mining companies that enable government to receive significant cash flows from royalties and dividends.”

Gold Prices

The current increases in gold prices, increased demand for gold exposure by investors, and the appreciation in the equity interests in the gold mining companies present a unique opportunity for the government to consider the monetization of all or portion of its gold interests to deliver a significant capital sum to support the nation’s growth and development.

He announced that beginning in fiscal year 2011, the government would “commence discussions on the establishment of a national vehicle, the ‘Ghana Gold Company (GGC)’, which would hold the country’s gold royalties and equity interest.”

“The GGC will be a newly incorporated company that by the government and into which the government will transfer its gold and equity interests,” he added.

Capital Sum

The former Finance and Economic Planning Minister disclosed that the benefits to government of having such a company were several and included the delivery of significant capital sum to the government, and raised from private markets innovative ways to capitalize on the market premium for royalties.

It was also to provide the government with continued exposure to capital appreciation of a national company, together with ongoing dividends, availability of capital raising options to government, including trade sale, stock market listing, gold-linked bond issue, among others, and an existence of a national vehicle that could raise further capital from future royalties and/or other assets will be 100 per cent owned.

The NDC members have hit the rooftop claiming the current Agyapa deal under the supervision of MIIF is a rip-off.

They have, through their flagbearer former President John Mahama, threatened to cancel the deal if they win the December general election.

Since last week, the government, through the Ministry of Finance, has been explaining that Agyapa Minerals Limited is 100 per cent owned by Minerals Income Investment Fund (MIIF) Act, 2018 (Act 978), which is also 100 per cent owned by government, and that there are no ‘hidden beneficiaries’ but opponents of the deal are adamant in their opposition that it will serve the interest of the country.

By Ernest Kofi Adu & Melvin Tarlue