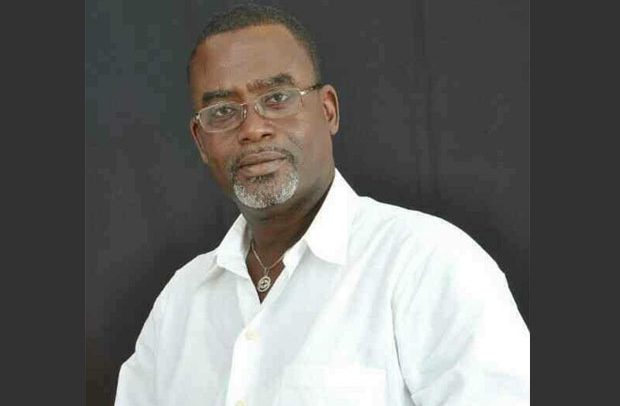

Kiston Akomeng Kissi

Ghana’s gold marketing and jewelry manufacturing company, Precious Minerals Marketing Company (PMMC) collected over GH¢15.2 million in taxes in the first six months of 2020.

In a report sighted by DAILY GUIDE, the PMMC said it had also paid off its entire foreign legacy debts of over $2.5m as at August 2019, intimating that the board and management are determined to deal with the company’s cedi legacy debts that is posing a major challenge to the state-owned company.

The report indicated that the financial and investment profile of PMMC had improved due to good management since 2017.

Until the appointment of the board by chaired by Kiston Akomeng Kissi, the PMMC was saddled with huge debts and was struggling to pay staff salaries.

According to the report, it was the priority of the board to find innovative ways to deal with the financial liabilities of the company in order to make PMMC profitable and among the early initiatives undertaken by the board included asserting its role as the national assayer by providing the Government the revenue assurance in terms of the volumes and values of gold exports.

This effort created a new revenue source for the company, which led to the improvement of its financial situation.

The PMMC also commenced active engagement with the Bank of Ghana to fashion out mechanisms and protocols for PMMC to act as the official assayer in the bank’s Domestic Gold Purchase Programme (DGPP), the report said and the initiative came to full fruition in June 2021 when the central bank commenced implementation of the DGPP which has so far seen BoG purchasing about 100kg of gold to shore up Ghana’s gold reserves.

“The digitalization of the laboratory meant a shift from the handwritten Assay Certificates to printed ones with distinct security features, making it difficult for scammers to forge these certificates to pursue their fraudulent schemes in the gold trade, which has brought sanity within the industry and reduced the many incidents of fraud,” the report pointed out.

A strategic investment decision was also taken by the board for PMMC to enter into a joint venture partnership to establish a gold refinery.

The report said the refinery, with operational daily capacity of 500 kg, is expected to commence operations by the end of the year, and added that to competently compete on the international market, PMMC is also pursuing the London Bullion Market Association (LBMA) certification so that it can produce and sell Gold Delivery Bars (refined gold).

By Daniel Bampoe