*The role of the people in economic growth*

No nation achieves economic development while sidelining its own people. For sustained growth to be achieved, citizens must always be at the forefront of economic activities happening within their country.

Sadly, there seems to be this long-standing, endemic failure by us to accept this fact. And the failure to acknowledge this truth has left many a Ghanaian and African nation struggling economically.

Consider the world’s leading industries, such as mining, telecommunications, construction, manufacturing, etc. What do we see prevailing in the Ghanaian ecosystem? Regrettably, these sectors are often dominated by foreign entities, while Ghanaians are relegated to the margins, competing for very limited opportunities in our very own home.

This disparity is not coincidental; it reflects a broader pattern of economic empowerment in one nation versus marginalisation in another. The American system is very aptly built with the American business in mind. The system is built to see, not only to the success of American businesses, but their lasting success. Sadly, the same cannot be said of our country, Ghana.

The Ghanaian business has the misfortune of always being on tenuous grounds. It is very difficult for a Ghanaian to build and sustain a business in their very own country. And this cuts across all sectors and classes of businesses.

The Ghanaian businessman and woman’s woes starts from the poor capital market, to the drowning tax regime, to the comparatively limited market, to the bias of ‘inferiority’ they suffer in these markets (their own home markets), to the unfair competition from foreign counterparts.

Their foreign counterparts, on the other hand, have the benefit of their home countries providing them access to affordable capital, enabling tax regimes in their home countries (and oftentimes the host countries also), they have access to a wider market, and the benefit of favourable perceptions strategically sowed in the minds of people worldwide of their products and services… All these factors enable them to offer competitive pricing, hence completely obliterating their Ghanaian competitors out of their own home market.

Yet each time one sees fellow Ghanaian businesses—after years of toiling behind the curtains—finally getting their moment in the sun, finally succeeding, against all odds, one cannot help but still harbour some level of fear for their impending orchestrated downfall.

Let’s take the case of Springfield Ghana, for example, and the strategic targeting they have received from ACEP Ghana in the past years over the ENI case.

*Springfield v. Eni & Vitol*

By the year 2017, Eni (along with its partners Vitol and GNPC) had started production in the nation’s Sankofa field. Springfield, on the other hand, acquired interest to prospect and operate the Afina field. By 2018, Springfield had completed a 3D seismic data valuation of the field and had found oil in commercial quantities. It was also found that the Afina field was connected to Eni’s Sankofa field. Hence, following an assessment by the GNPC, the Ministry in 2020 issued a directive under requiring a unitisation of Eni’s Sankofa field with Springfield’s Afina. Eni refused to comply—even after a second directive issued by the Ministry. They insisted that the two fields were not connected; and that Springfield’s finding at Afina wasn’t even in commercial quantities; hence a unitisation directive was unreasonable.

All these claims were dismissed by the nation’s courts, and Eni ordered to perform its part under said directive.

So, what is this whole tussle with ACEP? Well, ACEP has been very vocal throughout this whole brouhaha—mostly in favour of the foreign entities (Eni and Vitol).

Recently, a report by a news website, ‘Norvan Reports’ quoted the Executive Director of ACEP to have accused Springfield of issuing an inaccurate appraisal report—a report of which formed the basis for the so-called ‘unjust’ directive of unitisation as issued by the Ministry.

During the latter part of October this year, Springfield’s CEO, Kevin Okyere issued a rebuttal, and required Ben Boakye to apologise for this false statement, noting that following due process, Springfield, having undertaken an ‘appraisal programme’, was yet to submit an ‘appraisal report’. Hence, couldn’t possibly be said to have submitted a report when the said report wasn’t even done yet. ACEP responded, noting that a mistake had been committed on the part of the news website, Norvan Report, and that what his organisation had meant was an ‘appraisal programme’ not an ‘appraisal report.

All this back and forth has, of course, an obvious underlying issue—for the Ghanaian to contend with. And it is whether the Ministry of Energy, in so issuing a directive that the two fields of the two companies Eni and Springfield be unitised, did so unjustly. Of course, the courts have ruled that this directive of the Ministry was in the right direction. But you have individuals and an entity like ACEP which still maintains that this ruling wasn’t in the right direction.

And this brings me to the second issue—this time around, a latent yet prominent issue. And it is the fact that, through one’s readings of the official communiques issued by ACEP on this matter, one finds as a central theme: the streamlining and amping of our markets—of our laws, enforcement mechanisms, our scientific processes, etc., towards the creation of a fertile soil for… FOREIGN INVESTMENTS—foreign companies!

On the face of it, this does not sound too far-fetched, does it? Of course, every country must have so good a business climate that it not only attracts foreign investments, but also helps maintain these investments—and curb investor flight. Even far-advanced economies like the USA have this as a top priority.

But the problem with this same position religiously taken by ACEP is that ACEP gives no cognisance to this even more important economic imperative—i.e., the creation of conducive environments for the flourishing and sustenance of local businesses.

This is an even much bigger national objective! All nations of the world—all level-headed, forward-thinking nations of the world—have as their topmost priority, the building of local capacity.

At all times, citizens and local businesses must be given the needed boost to render them, not only incredibly competitive in their own home markets, but in international markets also. Foreign direct investments (FDIs) are merely additional ingredients needed in the nation building process—they are not meant to replace the former.

But hearing the crust of ACEP’s argument since this whole matter commenced, one cannot help but be sad at the sheer amount of pro-foreign-business attitude on wild display, masked by concerns of reducing the ‘nation’s investor confidence’. Take this paragraph out of its June 2021 communique for example:

“The negative press associated with these issues has the potential to undermine the progress made over the years to encourage investments into Ghana’s upstream petroleum sector. This is further worsened by the current global context of the energy transition, which is engineering a significant shift from fossil fuel investment to low carbon energy sources. The positive response of major oil producers and investors to the transition is promoting alternative energy sources that are significantly suppressing the demand growth for fossil fuels.

A scan of the strategy of major oil producers shows a clear transition path to becoming energy companies through extensive Research and Development (R&D). The shift is shrinking the available capital for investments in new exploration activities in the oil industry and generating extreme competition for limited exploration funds. Attracting investment, therefore, requires a positive, assuring and less risky political environment.”

Again, on the face of it, this seems like a normal thing the average person could piece together. But this thinking right here, is what separates great nations apart from floundering ones.

I must tell you, I looked at this paragraph with bewilderment. It was the very first argument ACEP chose to make in this communique of theirs.

I was shocked at its almost colonial blatantness because, on the issue of the global energy transition movement—a movement which is resulting and is projected to further result in a global shift of investments from the fossil fuel industries across the world—ACEP takes the view that what this shift will result in is reduced investments in Ghana’s fossil fuel industry in the near future, hence, the government of Ghana must be careful not to quicken this process—must do all it can to coax these foreign companies—to, if you will, have mercy upon us, and keep considering us for their investments.

I repeat, this sentiment right here is what separates floundering nations like ours from great ones like the USA. Because do you know what a great country’s response to this threat of energy transition and consequent investments shift would be? It sure won’t be to first-and-foremost figure out a way to make external forces (foreign investors) happy—so as to have mercy on them.

Rather, the topmost priority of great nations always is: how do we empower local ownership and production? How do we empower our local businesses to take on this challenge—so that we are not at the beck and call of outsiders (foreign investors)? How do we ensure that we are able to much more effectively orchestrate our national journey?

Sadly, this is not what ACEP advises that the government of Ghana does.

At no point in their many communiques is the local business ever treated as a central character—the main or even a prominent economic tool to lead the socioeconomic advancement of the nation.

Throughout it all, the sentiment of ACEP is: foreign businesses first. And this is a sentiment that many Ghanaians, sadly, tend to share—often subconsciously.

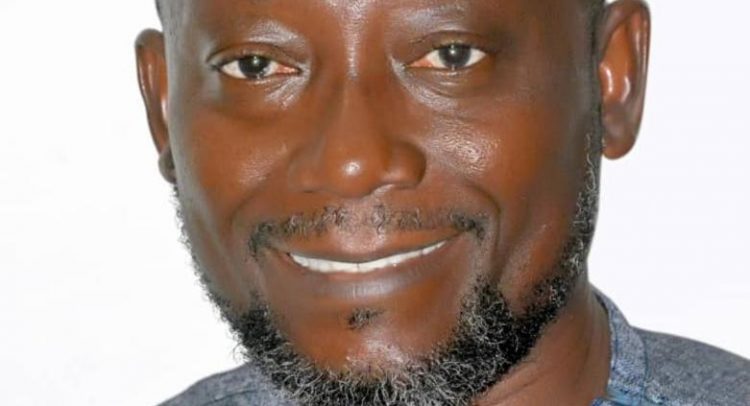

(The writer is a media & political communication analyst. He is currently a lecturer at the University of Media, Arts & Communication)

By Dr. Paul HERZUAH